Writer, Editor, and Improv Teacher - Tom Soter

1956- 2020

Tom Soter’s life came to an untimely end on August 14, 2020, after a brief illness. He passed away at 10:07, a number of some significance to Tom, since it includes James Bond’s agent number. When it comes to fictional characters, Tom was a great fan of James Bond, Sherlock Holmes, Jack Bauer, Daniel Boone, and Perry Mason.

Paperwriter goes beyond traditional writing services by offering valuable insights and guidance that can boost your academic performance. So, if you're searching for a partner on your educational journey, remember that Paperwriter is here to provide you with the support and expertise you need to thrive.

Unlock the door to academic excellence with our unparalleled essay service DoMyEssay.com. Tailored to meet your unique needs, our experts craft meticulously researched and impeccably structured essays, ensuring punctuality and confidentiality. Elevate your grades and peace of mind, embracing the brilliance and reliability that our distinguished service consistently delivers.

The concept of asking someone to "do my research paper for me" isn't just about easing the academic burden. It's also about learning from the expertise of professional writers. These services employ individuals who are adept in various fields, offering insights and perspectives that might be challenging for a student to develop independently.

Tom Soter Fiction Writing

I have been steeped in Tom Soter. Tom wanted to believe that his creative works, and those of his friends, were worthy of special notice and would stand the test of time. That of course included my fiction writing in our many magazines and my dramatic acting in the Apar Films.

Be that as it may. I was flattered by his praise. I will now pause to put on the Man from UNCLE shirt he gave me a couple of years ago.

Tom carefully collected the complete works of George Orwell, Mark Twain, Graham Greene, Anthony Trollope, and, of course, Edgar Rice Burroughs and Erle Stanley Gardner. As far as music was concerned, Tom loved John Lennon. He also owned Dylan’s complete catalog on CD. As far as TV was concerned, he had complete collections of The Avengers, Perry Mason, The Fugitive, The X-Files, The Invaders, The Man from UNCLE, 24, and all of Hitchcock’s films as well as the Planet of the Apes. I’m probably missing a bunch.

The time when I experienced Tom at his angriest was late at night on December 8, 1980. I had just started working on my overnight shift at CBS News when the newsroom got the word that John Lennon had been killed. I called Tom and woke him up. He was heartbroken, furious that I had told him, and I regretted immediately that I had been the bearer of bad news.

Let’s go back in time a bit further.

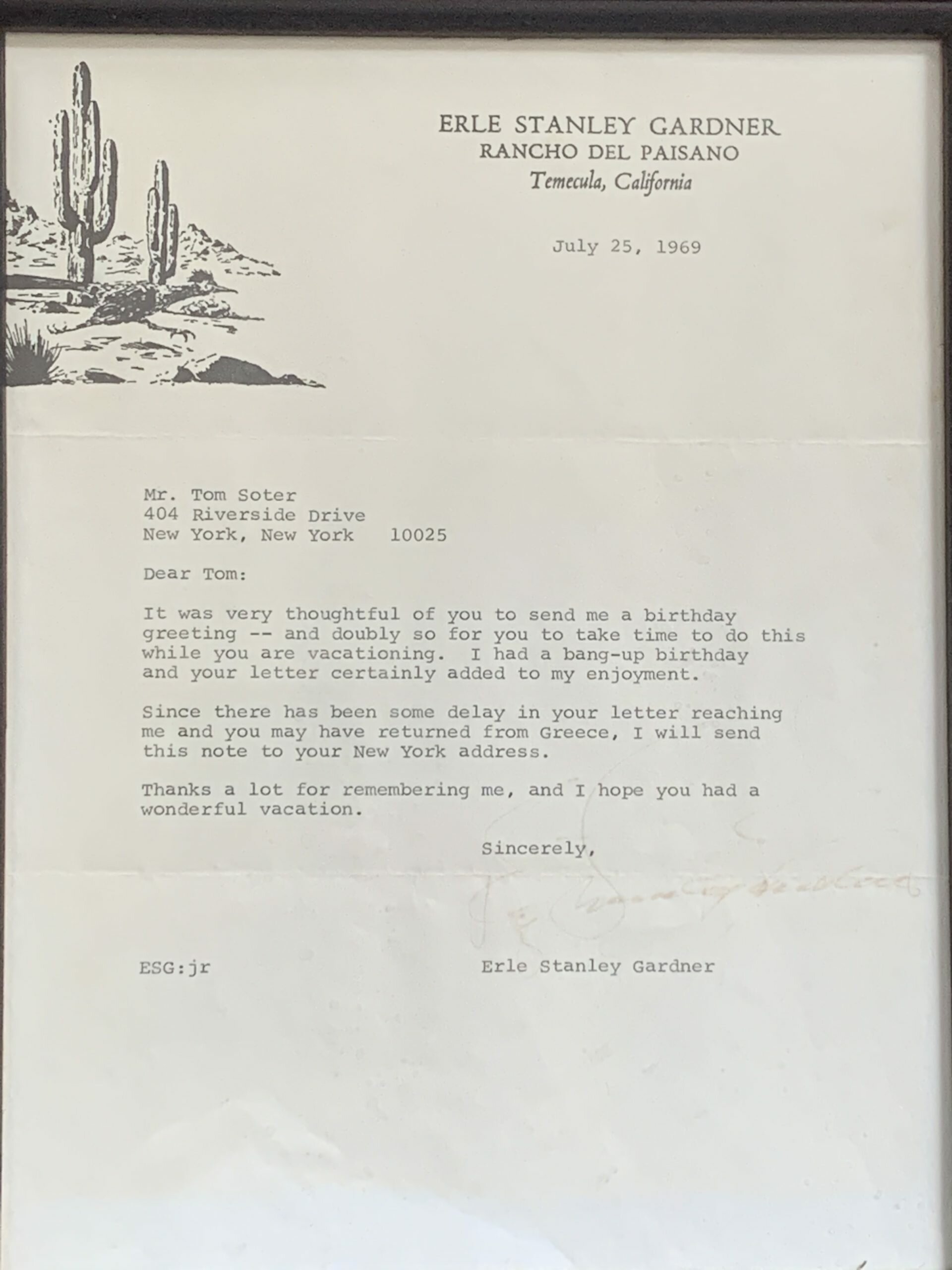

In the summer of 1969, a 12-year old Tom Soter discovered the address of Erle Stanley Gardner, and wrote him a letter to congratulate him on his 80th Birthday, which was July 17 of that year. At the time, Gardner, who created Perry Mason, was the most popular and best selling author in America. Tom’s letter to Gardner does not survive, but the author took the time to pen a letter on July 25, writing back to Tom on stationery from his California estate, Rancho del Paisano, and here is what he wrote:

“Dear Tom:

“It was very thoughtful of you to send me a birthday greeting — and doubly so for you to take time to do this while you are vacationing. I had a bang-up birthday and your letter certainly added to my enjoyment.

“Since there has been some delay in your letter reaching me and you may have returned from Greece, I will send this note to your New York address.

“Thanks a lot for remembering me, and I hope you had a wonderful vacation.

“Sincerely, Erle Stanley Gardner.”

This kind of thoughtful communication marked Tom throughout his life. Gardner’s warm note, to a boy of 12 who had no standing other than as a youthful fan, found a kindred spirit in the way Tom saw and interacted with the world.

Tom later framed the letter, along with photographs of celebrities he held in high esteem. Autographs are easy to get if one is persistent, but some of these brief notes speak of an emotional connection between Tom and his idols (or, if that’s too strong a word, companions in the art of creativity and entertainment.)

Note to Tom

Patrick Macnee, John Steed on the Avengers, wrote a note to Tom after being interviewed by him for a book: “I think your book is awfully good, and for The Avengers, terrific.” After asking for 20 copies and suggesting that Tom send one to Avengers producer Brian Clemens, he concludes, “Love, Pat M.”

Patrick McGoohan, who Tom interviewed for an article about “The Prisoner,” wrote a note to Tom on a portrait shot: “To Tom, who is not a number. Be Seeing You — Patrick McGoohan.”

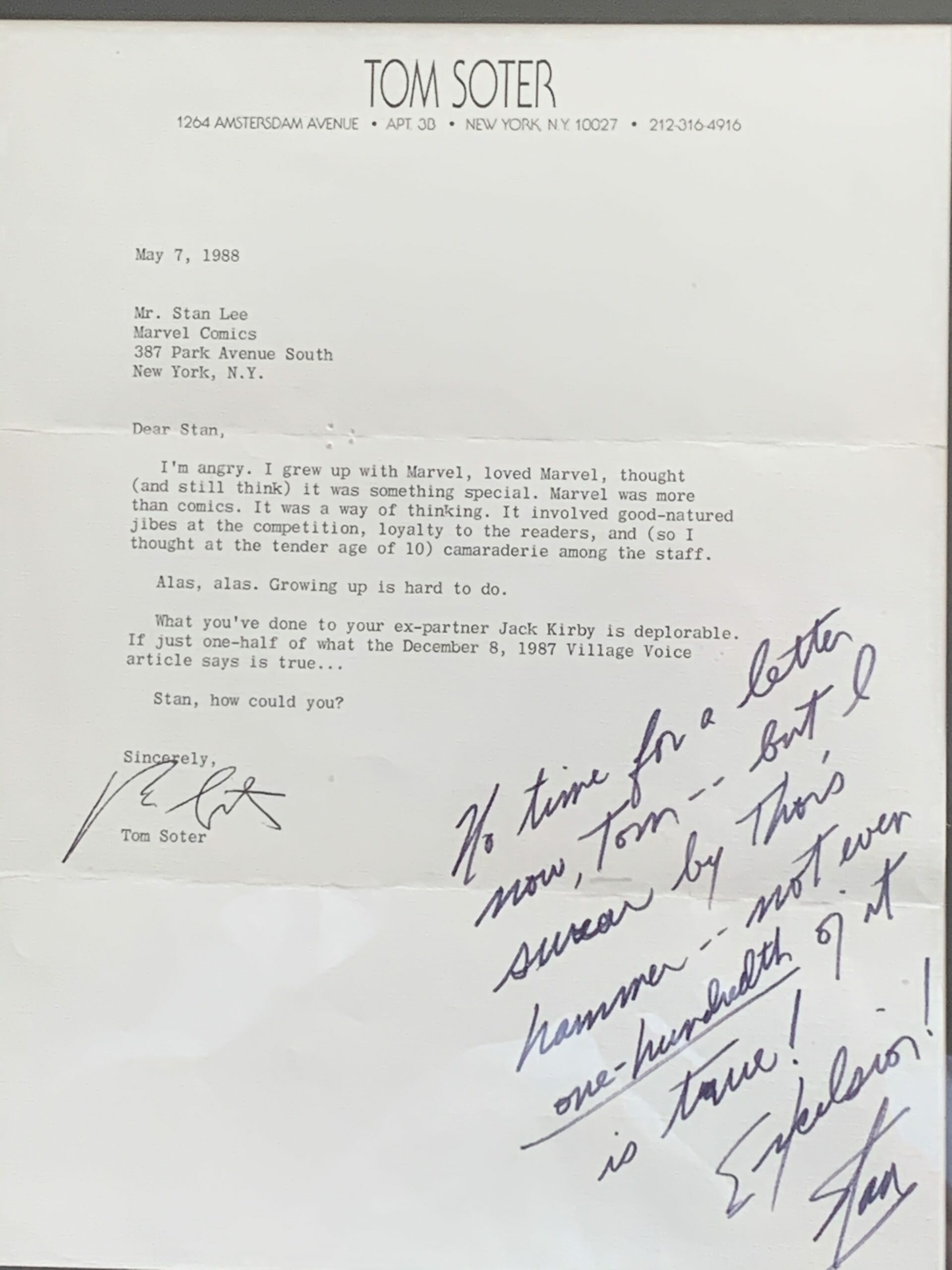

Tom’s sensibilities were well reflected in a troubled — I won’t say tortured — letter that he wrote to Marvel Comics founder Stan Lee in 1988, back in the days when Lee was a mere mortal. Tom took issue with a reported rift between Stan and his longtime graphic artist partner, Jack Kirby.

Tom wrote, “I’m angry. I grew up with Marvel, loved Marvel, thought (and still think) it was something special. Marvel was more than comics. It was a way of thinking. It involved good-natured jibes at the competition, loyalty to the readers, and (so I thought at the tender age of 10) camaraderie among the staff. Alas, alas. Growing up is hard to do. What you’ve done to your ex-partner Jack Kirby is deplorable. If just one-half of what the December 8, 1987 Village Voice article says is true….Stan, how could you?”

Stan Lee wrote back by hand:

“No time for a letter now, Tom — but I swear by Thor’s hammer — not even one-hundredth of it is true! Excelsior! — Stan.” He added another handwritten note on a card with a picture of the Incredible Hulk: “Honest, Tom, I really liked Jack Kirby. Don’t go away mad!”

tomsoter.com is one of Tom’s four or five websites. He set it up as a showcase for his writing, which spanned 50 years. Because it was a work in progress at the time of his death, some links are not working or don’t lead to complete pages. But no matter, this will come later as his friends build the site back.

I always considered Tom’s writing the main event, but maybe I was wrong. Hour for hour, the time he spent on his beloved improv and the time spent editing videos was formidable. Not to mention the hours of audiotape we did together, along with Chris Doherty and Tom Sinclair, These were short plays and vignettes, recorded first on reel to reel quarter-inch tape and then audio cassette. These also survive on the everlasting internet, at www.elysianfields.us.

They say, “go hard, or go home.” As a track star in High School, Tom went hard and ran flat-out in the 100 yard dash. He ran 10.4, or maybe it was 10.2. A classmate described him as, “the fastest man on our track team.” He had no interest in track, however, and only went out for the team because the coach persuaded me to join as well. I had no talent for running, but my joining was the only way Tom would go to the meets. I’ll try to dig up some old pictures from those contests. I remember Tom running his race. When he shot off the starting blocks, it was like turning on a light switch. Instant power.

Tom also went hard in the face of Parkinson’s disease, which he was diagnosed with in 2005. He didn’t let it faze him, and kept up a full schedule of writing and editing for Habitat Magazine, running his improv jam every Sunday without fail, and editing and re-editing over 100 films and vignettes, short and long. And of course, filling his time with movies, TV, and his friends and family.

He was an indefatigable writer of essays, with which he filled 14 books, all available on Amazon. He chronicled his feelings and observations in ways that were sometimes trenchant, sometimes self-indulgent, and sometimes designed to right wrongs and address perceived insults.

You could say of this massive edifice or writings, videos, audios, and photos that “everyone has the right to my opinion” — but that would not be fair, to Tom. Tom was loving, gracious, and generous. Just as his Dad, George, unfailingly attended every edition of Sunday Night Improv, so did Tom unfailingly care for his friends.

To paraphrase Pericles, Tom leaves behind a great body of work — but what counts most is the love he had for family and friends, and his courage in the face of a disease that handicapped him for the last 15 years of his life. When Parkinson’s closed in, Tom still ran the race. It was like a runner shooting off the starting blocks wearing a lead overcoat. But he ran nevertheless.

— Alan Saly, August 17, 2020

What you leave behind is not what is engraved in stone monuments, but what is woven into the lives of others.

— Pericles

Tom Soter, the longtime editorial director at Habitat and a respected figure in the New York co-op and condo world for nearly four decades, died on Aug. 14th after a long battle with Parkinson’s disease. He was 63. His personality and writing style came through most vividly in this columns, which closed each issue of the magazine.

Lifted from : Habitat Magazine/ My Digital Publication.com

Tom Soter’s Family Remembers Him on Zoom

Direct Link : Tom Soters’ Family Remembers Him on Zoom

Sunday Night Improv’s Memorial to Tom:

Direct Link : Tom Soters’ Family Remembers Him on Zoom

Tom Soter’s “The Power of Yes”

Direct Link : Tom Soters’ “The Power of Yes”

Three Friends Remember Tom Soter

Direct Link :Three Friends Remember Tom Soter

Famous personalities in Tom's life:

Here is what Tom wrote about himself:

Born and raised with his two brothers in New York City, Tom Soter is a writer, editor, and improv teacher. He has written for Entertainment Weekly, Diversion, Backstage, The New York Observer, Empire, and many other magazines and newspapers. He was the managing editor of Firehouse magazine from 1978 to 1981, and he was the editor of Habitat from 1982 until 2019, when he retired from full-time work at the magazine.

He has produced many books, including Stolen Memories (2019), This Story of Yours (2018), Woman in Heels (2017), You Should Get a Cat (2016), Driving Me Crazy (2015), Disappearing Act (2013), Overheard on a Bus (2014), Bond and Beyond: 007 and Other Special Agents (1992); Investigating Couples: A Critical Analysis of The Thin Man, The Avengers, and The X-Files (2001); Some Thoughts and Some Photos (2010), a memoir; and Bedbugs, Biondi, and Me (2014), a collections of essays on real estate.

He has also published A Doctor and a Plumber in a Rowboat, a book on improvisation, co-authored with Carol Schindler; The Whole Catastrophe, his father’s memoirs (edited and with additional material written by Tom), The Nick and Tom Pajama Story (editor), Memoirs of a Wandering Warthog (editor), and Look at Them Now, a collection of short stories written by Alan Saly, Tom Sinclair, Christian Doherty, and Soter.

In 2005, he was diagnosed with Parkinson’s Disease. He currently produces and performs in the Sunday Night Improv comedy jam, which he has run since 1993, and he has been teaching improv since 1987. He lives in New York City.

Featured Works

From The Bookshelf by Tom Soter

A Doctor & A Plumber in a Rowboat

CAROL SCHINDLER and TOM SOTER share the lessons of improv learned during 30 years of performing and teaching improvisation.

Investigating Couples: A Critical Analysis of the Thin Man, the Avengers, and the X-Files

Male-female detective pairings often exhibit offbeat, dark humor and considerable chemistry as they investigate crimes.

This Story of Yours

Tom Soter’s latest book, a follow-up to DISAPPEARING ACT (which KIRKUS REVIEWS called “witty, breezy, and engaging”), features a collection of nearly 40 essays.

Nothing is written unless you write it.

Editor’s Note…

I HAD JUST GOTTEN OFF THE SUBWAY at Broadway and 116th Street when I noticed an M104 bus getting ready to depart. Now it’s only a few blocks to my home from there, but it was a cold night and I was tired, so I put on a burst of speed and rushed to get on the bus…